| Forum Threads |  |

| Random Photo |  |

| Member Poll |  |

|

Recession Recession |  That is the word being thrown around these days. It seems to me that every day brings with it some further increase in how seriously screwed we are. First it was the stock markets, then the car makers. I have alot of questions that nobody can answer as it turns out. Questions like what will happen next and whether or not I should stock up on canned goods. I found this graph that pushed me even further towards the canned goods side of things, and would like to hear what you think about the graph, the crisis in general, and what the future holds in store for us: That is the word being thrown around these days. It seems to me that every day brings with it some further increase in how seriously screwed we are. First it was the stock markets, then the car makers. I have alot of questions that nobody can answer as it turns out. Questions like what will happen next and whether or not I should stock up on canned goods. I found this graph that pushed me even further towards the canned goods side of things, and would like to hear what you think about the graph, the crisis in general, and what the future holds in store for us:

Here's the description:

"This is a graphic of the Standard and Poor's stock index's annual returns, placing every year since 1825 in a column of returns from -50% to +60%. As you can see, it is a rough bell curve, with 45 of those 185 years falling in the +0-10% column. There are only 5 years each in the 40-50% and 50-60% return columns, and, through 2007, there were only one year each in the -31-40% and -41-50% columns. You can see where 2008 to date falls."

original link:

http://www.boingboing.net/2008/12/09/sp-returns-and-the-r.html |

|

| |

| |

| Comments |

on December 11 2008 04:10:39

Hmm, about the graph. The year isn't over yet, so Standard and Poor's stock index's annual returns for this year might very well be way less than -50%. Currently, we're only down 40% wich is better, but it still lands us in 1937-territory. Anyways, discuss. |

on December 12 2008 03:56:30

I'm still concerned that we've haven't seen the worst of this yet. Today it came out that it isn't only Stein Bagger that has been a fraud, but one of the founding NASDAQ directors has admitted that his investment fund was "%3Bjust a large Ponzi scheme"%3B, and has lost $50,000,000,000.00! |

on December 13 2008 15:15:56

More on Bernhard Madoff $50 billion Ponzi scheme. This thing has the size to take the market down by 20-33% if it cascades and causes a significant amount hedge funds to go broke.

Furthermore Dr. Doom and co are predicting a drop of between 20 and 50% of current levels.

For the next 12 months I would stay away from risky assets. I would stay away from the stock market. I would stay away from commodities. I would stay away from credit, both high-yield and high-grade. I would stay in cash or cashlike instruments such as short-term or longer-term government bonds. It's better to stay in things with low returns rather than to lose 50% of your wealth. You should preserve capital. It'll be hard and challenging enough. I wish I could be more cheerful, but I was right a year ago, and I think I'll be right this year too.

|

on December 13 2008 17:58:14

If you're going to edit the news item, then can't you do it so that it reads like a proper story? can't do anything from onboard. Either that or remove it alltogether. |

on December 13 2008 18:26:20

I like the news item, just that some felt that the image was a bit over the top as it took up the whole screen, and I agree with them. Tried to resize the image and that just made it look weird. Now people can look inside for the proper story, which they should, as then they can read our wonderful comments as well |

on December 13 2008 18:41:58

just move everything below where the image should be into the extended, no need for the explanation if there's no picture

anywyas, that ponzi thing is pretty scary |

on December 13 2008 22:05:59

The collapse of Madoff is likely to accelerate the disappearance of hedge funds.

NYTimes has yet another article on this, where they go into detail on some of the people who have lost their money, including the owner of the New York Mets, The Philadelphia Eagles, and several of the "old money" Jewish families in New York.

This really has the potential to crash the hedge fund world, and if it goes then the global markets will race after them to the bottom. Tragically funny how some of the most renowned people in business were in fact simply running a scam... |

on December 14 2008 04:31:48

And another Wall Street fraud uncovered today... seems to be a lot of these around. |

on December 28 2008 06:22:16

Taleb and Mandelbrot on the future... |

on February 10 2009 22:08:44

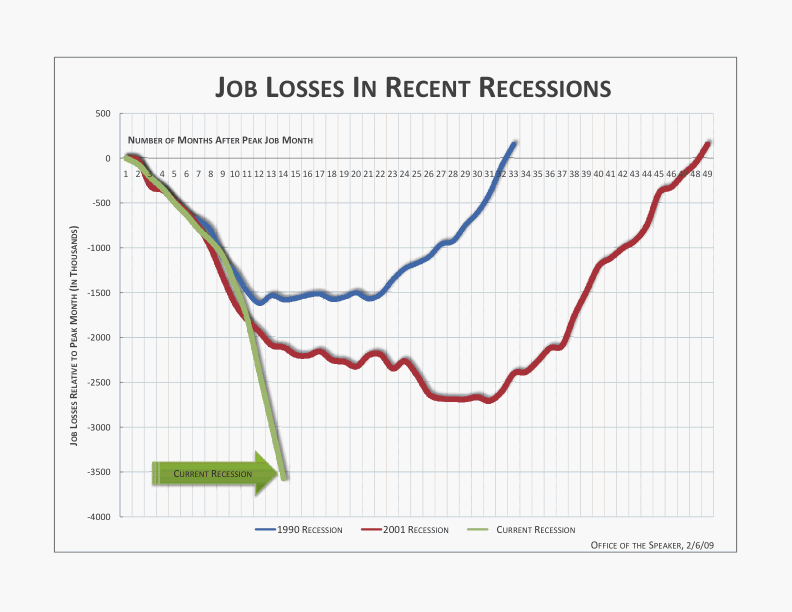

Here's another scary graph for you:

|

|

|

| Post Comment | |

Please Login to Post a Comment.

|

|

| Ratings | |

Rating is available to Members only.

Please login or register to vote.

No Ratings have been Posted.

|

|

|

| Login |  |

Forgotten your password? Request a new one here.

|

| |

| Last Seen Users |  |

| Obituaries |  |

You must login to post a message.

|

| |

|